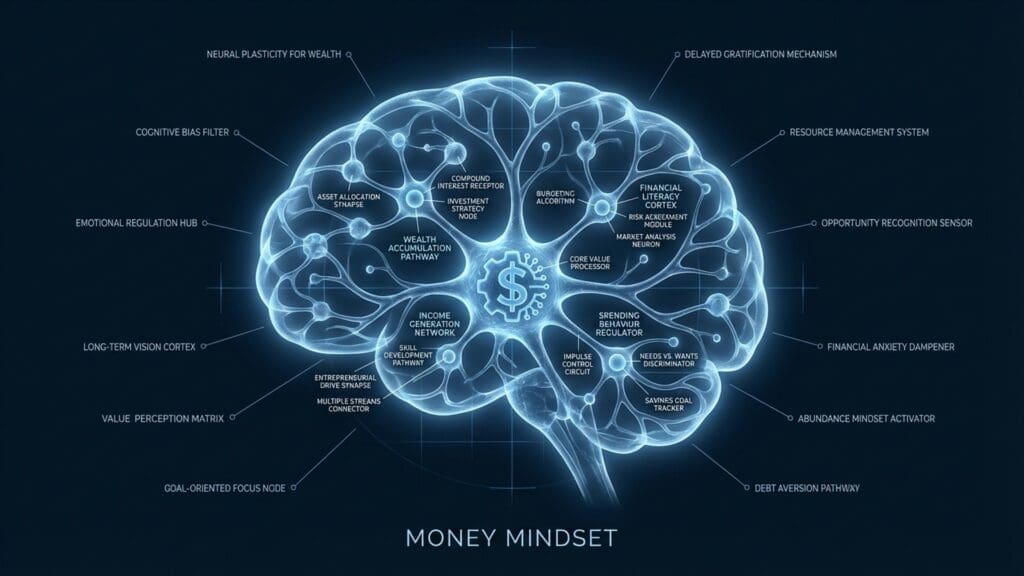

The subconscious scripts driving your finances. Identify and rewrite the limiting beliefs that cap your earning potential and financial growth.

The Evolutionary Design

Your brain is wired to survive. It constantly scans the environment for resources like food and shelter. Today, money represents those resources. Nature built a system to detect scarcity. When supplies ran low, your ancestors felt fear. This fear forced them to hoard and protect what they had. The brain treats a lack of money like a physical threat to your life.

The Modern Analogy

Money mindset is like the lens of a camera—if it’s smudged with fear or scarcity, it distorts everything you see about earning and spending. A dirty lens ruins a beautiful picture. You look at the world and see only problems. The opportunities are right there, but the smudge blocks the light. Your brain filters out the positive options. You focus on the dirt instead of the subject. The view becomes dark and blurry.

The Upgrade Protocol

You must wipe the lens clean. You do this by challenging your old automatic thoughts. Remove the grime of fear. When the glass is clear, the light gets in. You can finally focus on the opportunities in front of you. The picture becomes sharp. You stop looking at the distortion and start seeing the potential for growth. A clear lens captures the true value of the moment.

NEUROBIOLOGICAL CONTEXT

Money is rarely just about math; it is about emotion. “Money Mindset” refers to the subconscious beliefs and neural pathways that dictate how you earn, save, and spend. These scripts are often formed in childhood and operate in the background, influencing financial behavior before the logical brain even gets involved.

Your financial reality is often a reflection of your Reticular Activating System (RAS).

Scarcity Mode: If your brain is primed for scarcity (fear), the amygdala remains hyper-active. You essentially develop “tunnel vision,” focusing only on immediate threats and bills, blinding you to long-term opportunities or investments.

Abundance Mode: This is not magic; it is cognitive openness. A relaxed nervous system allows the Prefrontal Cortex to engage in abstract planning and risk assessment, which are required for wealth accumulation.

Many people suffer from financial trauma—a chronic stress response triggered by checking a bank account or discussing money.

The “Upper Limit” Breach: When you earn more than your subconscious believes you deserve, the brain may self-sabotage (unexpected spending) to return to a familiar baseline.

Desensitization: To fix this, you must normalize wealth. Exposure to financial literacy and successful peers rewires the brain to view money as a tool (neutral) rather than a threat (negative).

Join my inner circle for exclusive insights and breakthroughs to elevate your life.

Limited Availability

Your Journey to Unparalleled Personal and Professional Growth Starts Here

Limited Availability

A Truly Bespoke, One-on-One Journey with Dr. Sydney Ceruto

Download The Influence Within and discover how small shifts lead to big transformations.