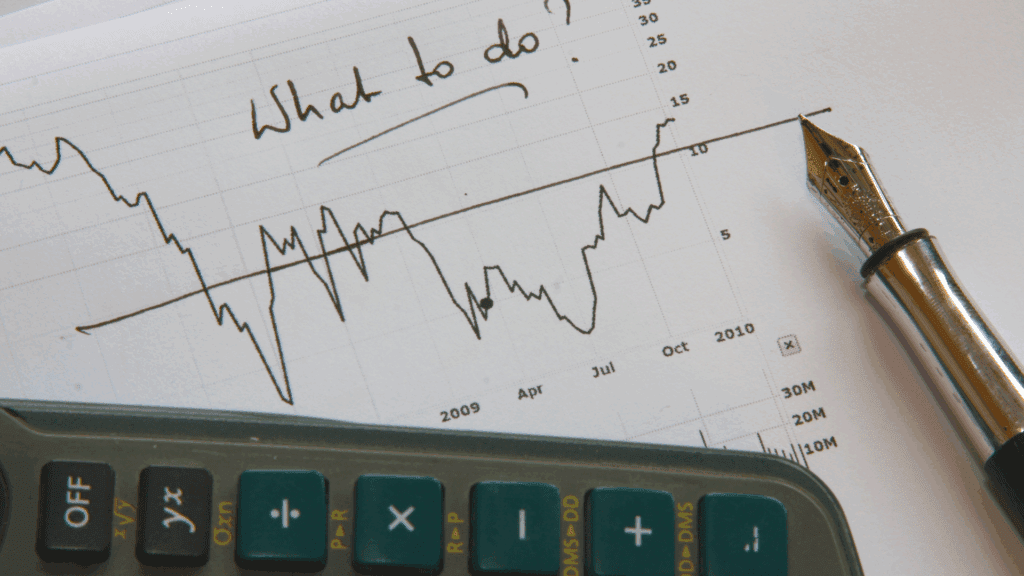

Financial decision-making isn’t just about crunching numbers; it’s about understanding how your brain processes choices and influences your behavior. The surprising truth is that many of our financial behaviors are driven by unconscious processes rooted in neuroscience. Your brain’s wiring affects how you evaluate risks, weigh rewards, and ultimately choose your financial path.

For instance, the brain’s reward system often prioritizes immediate gratification over long-term gains, which is why saving for the future or avoiding impulsive purchases can feel like an uphill battle. Similarly, emotional responses like fear during market volatility or overconfidence after a financial win can shape decisions in ways we don’t even realize. These automatic reactions make understanding your brain not just insightful—it’s essential for making financial decisions that serve you well.

By learning to work with your brain, rather than against it, you can break free from these unconscious patterns and take control of your choices. This knowledge empowers you to make smarter financial decisions, whether you’re navigating personal investments, leading in the corporate boardroom, or planning for retirement. Understanding how your brain’s biases and tendencies influence your decisions is the foundation for greater financial success.

When you leverage neuroscience, you shift from reacting to your instincts to proactively guiding your decision-making process. This isn’t just about improving financial outcomes—it’s about unlocking the confidence and clarity needed to transform how you approach every choice. With the right insights, smart financial decisions becomes less daunting and more achievable, no matter the stakes.

The Brain and Financial Choices

Every financial decision you make—no matter how big or small—is influenced by your brain. While logic plays a role, neuroscience reveals that your emotions, instincts, and biases often tip the scales. These unconscious processes are why decisions can feel so effortless in some cases and overwhelming in others. To make smarter financial decisions, it’s crucial to understand how different parts of the brain work together—and sometimes against each other—when money is involved.

Here’s how the key players in your brain shape financial decision-making:

Prefrontal Cortex: Often called the “CEO” of your brain, this area is responsible for rational thought, long-term planning, and self-control. It helps you weigh the pros and cons, calculate risks and rewards, and stay aligned with your financial goals. However, when emotions run high, the prefrontal cortex can take a back seat, leaving impulsive instincts to drive decisions. Strengthening this part of the brain through mindfulness or structured decision-making processes can lead to smarter financial outcomes.

Amygdala and Insula: These are the brain’s emotional centers, responsible for processing fear, anxiety, and risk. They become most active when you’re avoiding losses or faced with uncertainty. For example, during a volatile market, the amygdala might trigger fear-based reactions, such as selling investments prematurely. While these areas are essential for survival, they can sometimes hinder your ability to take calculated risks that lead to growth. Recognizing when fear is guiding your choices is a powerful step toward financial confidence.

Ventral Striatum: This is your brain’s reward system, lighting up when you anticipate financial gains or experience a “win.” It’s what makes landing a big deal or seeing an investment pay off feel so exhilarating. However, it can also drive impulsive behavior, pushing you toward riskier decisions in search of that next reward. Understanding this system can help you balance short-term gratification with long-term financial stability.

Your brain’s collaboration between these regions determines how you approach spending, saving, and investing. By recognizing these influences, you can learn to harness their strengths while minimizing their pitfalls—an essential skill for anyone looking to make smarter financial decisions. Let your brain be your ally, not your obstacle, on the path to financial success.

Why We Don’t Always Make Smarter Financial Decisions

Despite having the capacity for rational thinking, our brains often rely on shortcuts called cognitive biases. These biases can cloud judgment and lead to less-than-optimal financial decisions.

For example:

- Loss Aversion: You’re more motivated to avoid losses than to pursue equivalent gains.

- Overconfidence: You believe your predictions are more accurate than they really are.

- Anchoring Bias: You rely too heavily on the first piece of information you encounter.

I’ve seen these biases at play in my work. Take Matt, a hedge fund manager who struggled with overconfidence after a series of wins. Together, we implemented systems to ensure his decisions were grounded in data rather than emotion, helping him maintain balance during high-stakes moments.

Tips to Making Smart Financial Decisions

Understanding how your brain influences financial decision-making is just the first step. To truly take control, you need actionable strategies that align with how your mind works. Here are some tips to help you make smart financial decisions:

- Pause Before Big Decisions: When faced with a high-stakes financial choice, give your brain time to process. A simple pause allows your prefrontal cortex—the logical part of your brain—to weigh in, rather than letting emotions take over.

- Set Long-Term Goals: Set Long-Term Goals: Your brain thrives on clear direction. By defining specific financial objectives and creating a structured spending plan, you reduce the likelihood of being swayed by short-term rewards or market fluctuations.

- Practice Emotional Regulation: Use mindfulness techniques like deep breathing or meditation to stay calm during volatile markets. Regulating your emotions helps you think more clearly and make smarter financial decisions.

- Learn From Past Choices: Reflect on financial decisions that worked well and those that didn’t. This builds self-awareness, helping you identify patterns and avoid repeating mistakes.

By implementing these strategies, you can align your financial decisions with your goals and make smarter, more confident choices. Remember, it’s not about being perfect—it’s about understanding your brain’s strengths and using them to your advantage.

Long Term Strategies to Make Smarter Financial Decisions

The good news? You can train your brain to overcome these biases and make smart financial choices with confidence. Here are some neuroscience-backed strategies I use with my clients:

1. Recognize Emotional Triggers

Emotions like fear or excitement often hijack our ability to think rationally. Before making a major financial decision, ask yourself: “Am I reacting emotionally, or am I thinking this through?”

Pro Tip: Use mindfulness practices, such as deep breathing, to regulate emotions and reset your focus. This helps activate your prefrontal cortex, allowing logic to take the lead.

2. Understand Your Biases

Awareness is the first step to overcoming biases. Reflect on past financial decisions to identify patterns. Do you tend to avoid risks, like Sarah, a global bank executive I worked with who hesitated during high-pressure negotiations? Once she recognized this pattern, we worked on reframing her perspective to focus on potential gains rather than losses.

3. Use Neurofeedback

One of the most exciting tools I’ve introduced to clients is neurofeedback. This technology tracks brain activity in real-time, helping you understand how your mind reacts to risk and reward. It’s like having a mirror for your brain—allowing you to make adjustments that lead to smarter, more confident decisions.

Real-World Applications of Neuroscience in Finance

Understanding the brain isn’t just for academics; it has real, tangible benefits in finance. Here’s how I’ve applied neuroscience to help clients transform their decision-making:

- A senior executive at a global bank used emotional regulation techniques to lead her team through a high-stakes restructuring. By focusing on her prefrontal cortex’s strengths, she made decisive choices that inspired confidence in her team.

- A group of financial planners revamped their communication strategies to calm clients’ fears during market downturns, increasing retention and satisfaction by 25%.

How Neuroscience Empowers Financial Success

The financial world is unpredictable, often filled with volatility and uncertainty, but neuroscience offers a powerful lens through which to view these challenges. By understanding how your brain processes financial information and decisions, you gain the ability to navigate complexities with greater confidence and clarity. Neuroscience doesn’t just help you analyze numbers—it helps you master your instincts, emotions, and thought patterns to make smarter financial decisions.

By combining financial knowledge and decision-making skills with neuroscience insights, you can unlock several critical advantages:

Avoid Emotional Pitfalls During Volatile Markets

When markets fluctuate, emotions like fear and greed can drive impulsive decisions, such as panic selling or chasing fleeting gains. Neuroscience teaches you how to regulate these emotional responses, allowing your prefrontal cortex to take the lead. This helps you maintain a clear, rational approach to your investments, even when the financial landscape feels chaotic.

Make Decisions That Align with Long-Term Goals

Many financial missteps occur when short-term gratification takes precedence over long-term success. Understanding your brain’s reward system allows you to balance immediate impulses with strategic thinking. By training your brain to focus on your larger financial objectives, you can make choices that consistently move you closer to your goals.

Gain a Strategic Edge

Whether you’re managing investments, implementing spend analysis solutions, or leading teams., neuroscience gives you a unique advantage. It provides tools to identify cognitive biases, optimize decision-making processes, and predict behavioral trends in others. This heightened awareness enables smarter financial decision-making, whether you’re guiding your team through uncertainty or making high-stakes investment calls.

This is why my work focuses on helping clients bridge the gap between science and strategy. By leveraging neuroscience, I equip them with the tools they need to overcome challenges, seize opportunities, and consistently make smarter financial decisions. Neuroscience isn’t just an advantage—it’s the key to thriving in today’s complex financial world.

Unlocking Smarter Financial Decisions

Understanding how your brain works is more than just a fascinating exercise—it’s a transformative tool for navigating the complexities of making smarter financial decisions. When you recognize what your brain responds to, from emotional triggers to cognitive biases, you gain clarity and control over your choices. This self-awareness is the foundation for smarter financial decisions, enabling you to align your actions with long-term goals while avoiding the pitfalls of impulsive or fear-driven reactions.

By applying neuroscience insights, you can unlock a deeper understanding of yourself and the factors influencing your financial success. Whether you’re striving for personal growth, guiding a team, or making high-stakes investments, this knowledge empowers you to approach decisions with confidence, strategy, and balance.

Embrace the opportunity to refine your approach to decision-making. With the right tools and mindset, smarter financial decisions are within reach, and the path to success becomes much clearer.